In my last post on “Understanding The Vision in a “Visionary Founder” I tried to tackle the softer side of what an investor looks for, and as a continuation of the thread, I want to try and tackle how that vision evolves into a brand and brand culture and brand positioning.

Last night, I had the chance to watch the movie ‘Bones Brigade: An Autobiography’, about the lives and histories of many of my childhood skateboarding heroes… including Steve Caballero, Tony Hawk, Mike McGill, Lance Mountain, Rodney Mullen, and several others who were all part of the Powell & Peralta skate team: the Bones Brigade.

As I relived those memories, I recalled how passionate I felt about the sport because of how these guys made it amazing and accessible at the same time. They invented tricks, such as the ollie, which democratized skateboarding for kids so they could enjoy skating on their streets rather than hoping to see a half-pipe pop-up in their neighborhood. On a personal note, I can remember as a kid wishing I could be part of the Bones Brigade and riding with cool pro-kit from my favorite skaters. All the skater kids in school had Powell-Peralta stickers and patches sewn on (typically by disapproving mothers) onto our backpacks. I even went as far as building my own quarter-pipe and ‘branding it’ Powell Peralta!

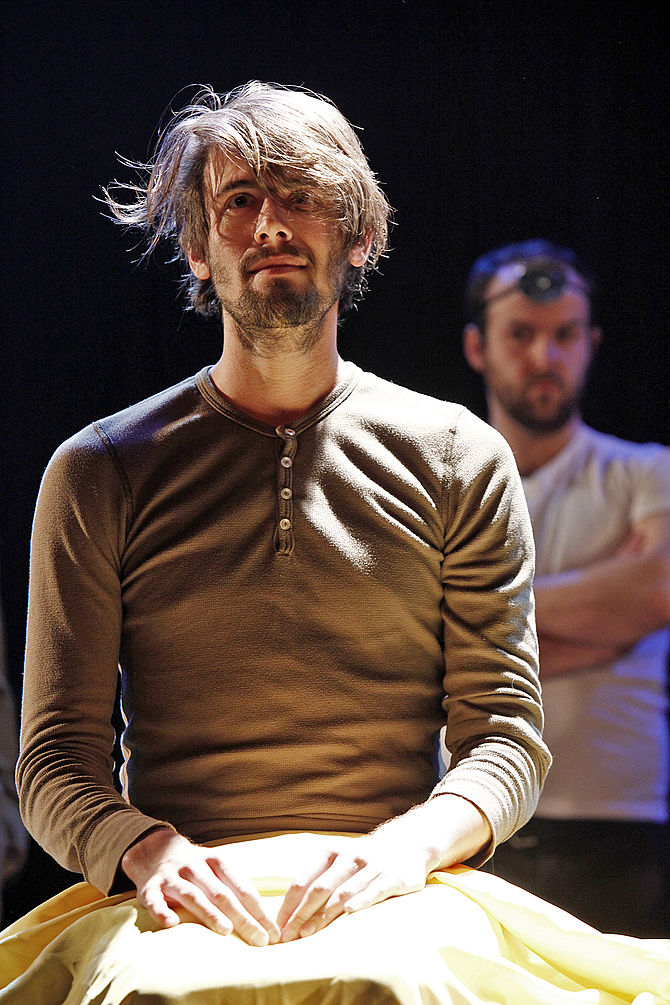

Yours truly (many moons ago & with hair) launching off of my home-made Powell-Peralta branded quarter-pipe. I made it in shop-class.. in case you’re wondering, I got a good grade in that class.

However, with more adult eyes, what really impresses me now is the visionary machine that was Stacy Peralta (one of the two co-founders of Powell & Peralta) in crafting the Powell-Peralta & Bones Brigade brands that captured the spirit of skating in a way that lured kids like myself and my friends in to want to connect with it and live it.

Great brand lasts a lifetime.

As an observer and appreciator of great branding (the way some appreciate art), It’s amazing to see how, to this day, even long after its death in 1991 (the company fell apart due to a founder dispute) and recent rebirth (the founders patched things up by request of the team) the Powell&Peralta / Bones Brigade story stands out as an inspiring tale of a visionary founder that created an awesome brand and culture, and positioned it to stand out above and beyond the crowd of the other me-too companies of its time. The fact the Bones Brigade autobiographical movie came out recently and the brands have been succesfully reborn almost 20 years on from their heyday, is a testament to how much the whole brand, and what it stood for, stuck with many of my generation.

It starts with a vision.

Stacy Peralta, helped create a brand and culture upon which he positioned the company in a way that resonated with his customers and led to Powell & Peralta’s success both in attracting the kind of riders that lived this vision to join his team, but also in successfully selling many skateboard decks to kids wanting to live his vision themselves.

As a bit of background, Stacy himself was a champion skateboarder and member of the famous Z-Boys (arguably the first skateboarding team in the world), and in many ways that helped shape his vision about what a team should be like, having himself experienced the eventual falling out and disbanding of the Zephyr team.

Stacy’s vision of forming a better team without the attributes that broke apart the Z-Boys, drove the engine that would come to power the Bones Brigade brand from the very beginning. In the movie, you can hear Stacy himself share his vision (at minute 8:53) about how he wanted to make a team that would last, and (at minute 7:40), you can also hear how his co-founder George Powell narrates Stacy approaching him on the idea of building a team with a specific ethos, which eventually became the Bones Brigade.

To dig deeper, the brand’s development and success wasn’t accidental (although there were likely many many many failed experiments along the way)… rather, it was through meticulous work that Stacy Peralta and his team developed a culture, tone, and imagery to communicate the values and positioning he wanted to convey for the brand, both externally and internally.

It was this hard work, as well as Stacy’s ability to inspire his team, that can be attributed for keeping the Bones Brigade together for as long as they did. In one part of the movie, you can even hear several riders struggle with various aspects of their success, but ultimately staying with the team for Stacy. If Stacy had simply been driven simply by money (or an ‘exit’) he wouldn’t have conveyed the genuine care necessary to merit the loyalty of his team.

To showcase the point about how Stacy chose how to communicate his vision through his brand, in the movie (starting at minute 29:40), Stacy Peralta shares how his marketing campaigns, ranging from the burning of a car while the guys posed for pictures, and the crazy advertising style choice over the typical ‘action shots’ of the industry’s advertising at time, were chosen to cement the new brand’s tone and voice as different from the rest of his competitors that were pushing out bland ads in the magazines of the day. I’m not sure they knew ‘for a fact’ that these crazy ideas would 100% represent what they wanted to convey and convert into sales, but I’m pretty sure they knew that if they did what everyone else was doing, they’d for sure NOT be able to be different in the eyes of their customer.

From the Bones Brigade website:

Stacy recruited the skaters and handled marketing along with his longtime creative cohort Craig Stecyk III. Rejecting the expected action shot marketing, they used their young team to create esoteric images conveying the culture’s sarcasm and disenfranchised dark humor. While spitballing about his stable of skaters, Stacy commented that he never wanted to call them a “team,” a label that invited all kinds of jock baggage. Craig shrugged and simply said, “Bones Brigade.”

In effect, Stacy understood his customers and how to position his brand within the skateboarding competitive landscape of the time, and he recruited those that shared his vision, including the Bones Brigade team of skaters along with artists like Craig to help him evolve and communicate his vision and branding strategy to make it stand out from the crowd. Stacy & George worked hard to recruit the right riders, work with the artists that understood the brand, hire staff to help them build it, and attract customers that lived it.

As with most companies, that’s not to say that all was rosy within the Powell & Peralta company. In one segment of the movie, George talks about the disgruntlement that some of his more senior factory employees felt at the fact that his young team riders were making upwards of $20,000 a month from deck royalties.. however, it seems that George & Stacy were able to at least convey the importance of the Bones Brigade for the company’s success and managed to convince their factory employees to stay so that things could carry on for the brand. In effect, sometimes not everyone will agree with your vision, but sometimes you need to made difficult decisions.

And continues with Positioning and Branding.

Even if at times he was merely experimenting, Stacy Peralta intrinsically knew that what would make Powell & Peralta and the Bones Brigade successful, would be to have a strong positioning and branding strategy to help them differentiate from their competitors and to help bring the industry into the mainstream (for more on the difference between branding and positiong, read this article).

It was this solid company culture stemming from a strong founder vision around building a winning team, a clear positioning strategy of being different, and a strong brand values that powered Powell & Peralta and the Bones Brigade brands to success, and it was their consistency in execution, ranging from the art on the decks to the arguably kitsch videos they created (such as the classic “The Search for Animal Chin“), that allowed Powell & Peralta to dominate the skate scene during this era and to cement itself in the hearts of many kids around the world for many years to come.

In conclusion, as you consider starting or evolving a startup, give thought to what really drives you.. determine what’s your vision, and once you know the ‘why’ and who your customer is, then communicate it and your brand’s values and positioning with your employees and partners so that your product or service is consistent with everything you say and do for your customers. Potential investors know that companies that nail down their branding and positioning strategy company-wide, are that much more likely to succeed in the sea of competitive startups out there.

In case you are wondering why I choose skateboarding as an analogy for this post, it’s because I believe there are many similarities between startups and skaters:

1) Entrepreneurs, like skaters get knocked down many many times before they succeed, but they keep on getting back up.

2) Startup life like skate life is very much its own culture, operating at a different speed and risk level than others.

3) By having a movie that highlights some of the key points, if you want to hear them from the founders directly, you can simply rent it.